Financial Review FY2024

>> View Financial Statement FY2024

>> View Financial Archive

>> View Financial Statement FY2024

>> View Financial Archive

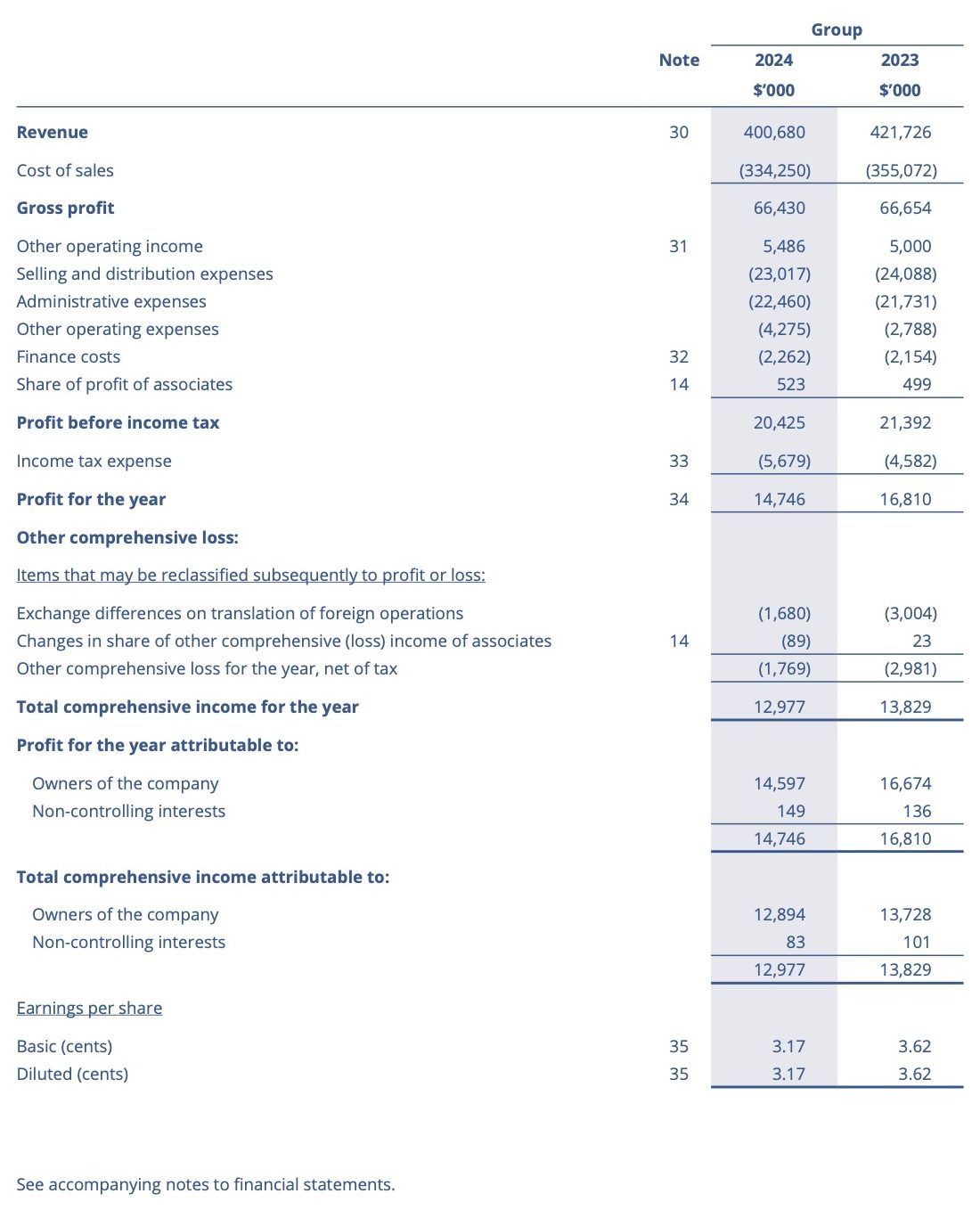

Revenue

For the six months ended 30 June 2024 (“2H24”), the Group reported revenue of $204.935 million, an increase of 6.68% from $192.105 million in the corresponding period ended 30 June 2023 (“2H23”). Growth was reported across all of the Group’s segments, driven by the expanding economy in the Southeast Asia region.

For the financial year ended 30 June 2024 (“FY2024”), the Group’s revenue decreased by 4.99%, a decline of $21.046 million from $421.726 million in the last financial year (“FY2023”) to $400.680 million in the current financial year.

The Cable & Wire (“C&W”) Segment’s revenue decreased by 3.17%, a decline of $8.877 million from $280.228 million to $271.351 million. The decline in revenue was due to completion of deliveries for certain private sector construction projects in Singapore. In contrast, higher sales volume was reported in Malaysia and Vietnam’s C&W segments, primarily driven by growth in private sector construction activities.

The Electrical Material Distribution (“EMD”) Segment registered revenue of $95.064 million, a decline of $13.295 million, or 12.27% lower than the $108.359 million in FY2023. This decline in revenue was primarily due to a significant reduction in the Electronics Cluster during FY2024, amid the cyclical downturn in the semiconductor industry. Additionally, there was a decrease in revenue in the Chemical, Oil & Gas Cluster. However, these were partially offset by increased revenue from the Building and Infrastructure Cluster, driven by higher deliveries to data centers.

Revenue from the Test & Inspection (“T&I”) Segment increased by 4.30%, or $1.226 million, from $28.485 million in FY2023 to $29.711 million in FY2024. This increase was largely driven by higher revenue from the rise in NonDestructive Testing activities, as more jobs were carried out for both the ongoing and new projects in Indonesia, Malaysia, and Singapore.

Revenue from the Switchboard Segment decreased by 2.15%, from $4.654 million in FY2023 to $4.554 million in FY2024, due to fewer government projects in Brunei.

Gross Profit

Gross profit (“GP”) increased by $2.702 million from $31.419 million in 2H23 to $34.121 million in 2H24. The gross profit margin (“GPM”) increased from 16.36% in 2H23 to 16.65% in 2H24 in line with improved margin in the C&W segments.

The Group’s GP for FY2024 decreased 0.34% to $66.430 million from $66.654 million in FY2023. GP margin increased by 0.77% from 15.81% in FY2023 to 16.58% in FY2024.

Other operating income

Other operating income for 2H24 increased by $1.480 million from $1.211 million in 2H23 to $2.691 million in 2H24.

For FY2024, the Group recorded other operating income of $5.486 million, an increase of $486,000 compared to $5.000 million in FY2023. This increase was primarily attributed to a higher foreign exchange gain and higher scrap sales in FY2024. However, this was partially offset by the absence of allowances for doubtful debts written back and the fair value gain on derivative financial instruments (“DFI”) that were recorded in FY2023.

Selling and distribution expenses

Selling and distribution expenses for 2H24 decreased by $553,000, a drop of 4.66% compared to 2H23. For FY2024, selling and distribution expenses decreased by $1.071 million, a drop of 4.45% compared to FY2023. This was mainly due to decreases in business operation costs and staff costs which were aligned with the lower revenue.

Administrative expenses

Administrative expenses for 2H24 increased by $493,000, up 4.39% compared to 2H23. For FY2024, administrative expenses increased by $729,000, up 3.35% compared to FY2023. This increase was mainly due to higher depreciation charges, increased director remunerations and rise in information technologies related expenses.

Other operating expenses

Other operating expenses for 2H24 decreased by $437,000, a 17.91% drop compared to 2H23. For FY2024, other operating expenses increased by $1.487 million, or 53.34% compared to FY2023.

This was largely attributable to the net impact of a higher fair value loss on DFI recorded in FY2024, reversing from the fair value gain on DFI recorded in FY2023. Additionally, the increase in other operating expenses was driven by an impairment loss on property, plant and equipment (“PPE”) in Cambodia and higher loss allowance for trade receivables, partially offset by a lower impairment loss on ROUA for a leased building in Cambodia recognised in 2H24. The impairment losses on PPE and ROUA were attributable to the continued unfavorable performance of a subsidiary in Cambodia.

Finance costs

Finance costs for 2H24 and FY2024 increased by $141,000 and $108,000, respectively, mainly due to increase in borrowings and higher interest rates on short-term bank loans.

Share of profit of associates

The higher share of profit from associates was primarily driven by increased profit reported by Nylect Group during the current financial year.

Profit before income tax

The Group’s profit before income tax (“PBT”) increased by $4.536 million, from $6.476 million in 2H23 to $11.012 million in 2H24, in line with the higher revenue achieved in 2H24.

PBT for FY2024 decreased by $967,000 to $20.425 million in FY2024 from $21.392 million in FY2023, primarily due to lower revenue in FY2024, the absence of reversals for doubtful debt allowances, fair value adjustments on DFI, and impairment losses on PPE. These were partially offset by a lower impairment loss on ROUA and higher foreign currency exchange gains.

The C&W Segment’s PBT for FY2024 increased by $1.839 million from $17.475 million to $19.314 million, mainly driven by higher GP achieved and higher foreign currency gains, which offset the effects of fair value adjustment on DFI.

The EMD Segment’s PBT declined by $4.389 million from $7.527 million to $3.138 million, in tandem with lower revenue and lower GP in FY2024.

The T&I Segment’s loss before tax for FY2024 decreased by $1.566 million, from $3.811 million to $2.245 million. This was primarily due to the lower impact of the impairment loss on ROUA recognised in the current financial year, and the effects of the impairment loss on PPE recognised in FY2024.

PBT from Switchboard Segment decreased by $18,000 or 7.41% compared to FY2023.

Income tax expense

Income tax expense for 2H24 and FY2024 increased by $1.592 million and $1.097 million respectively. The increase was primarily due to higher taxable profit for the current financial year. The underprovision in income tax expense and deferred tax expense in prior years were recognised after finalisation of the qualifying expenditure claims with the tax authority.

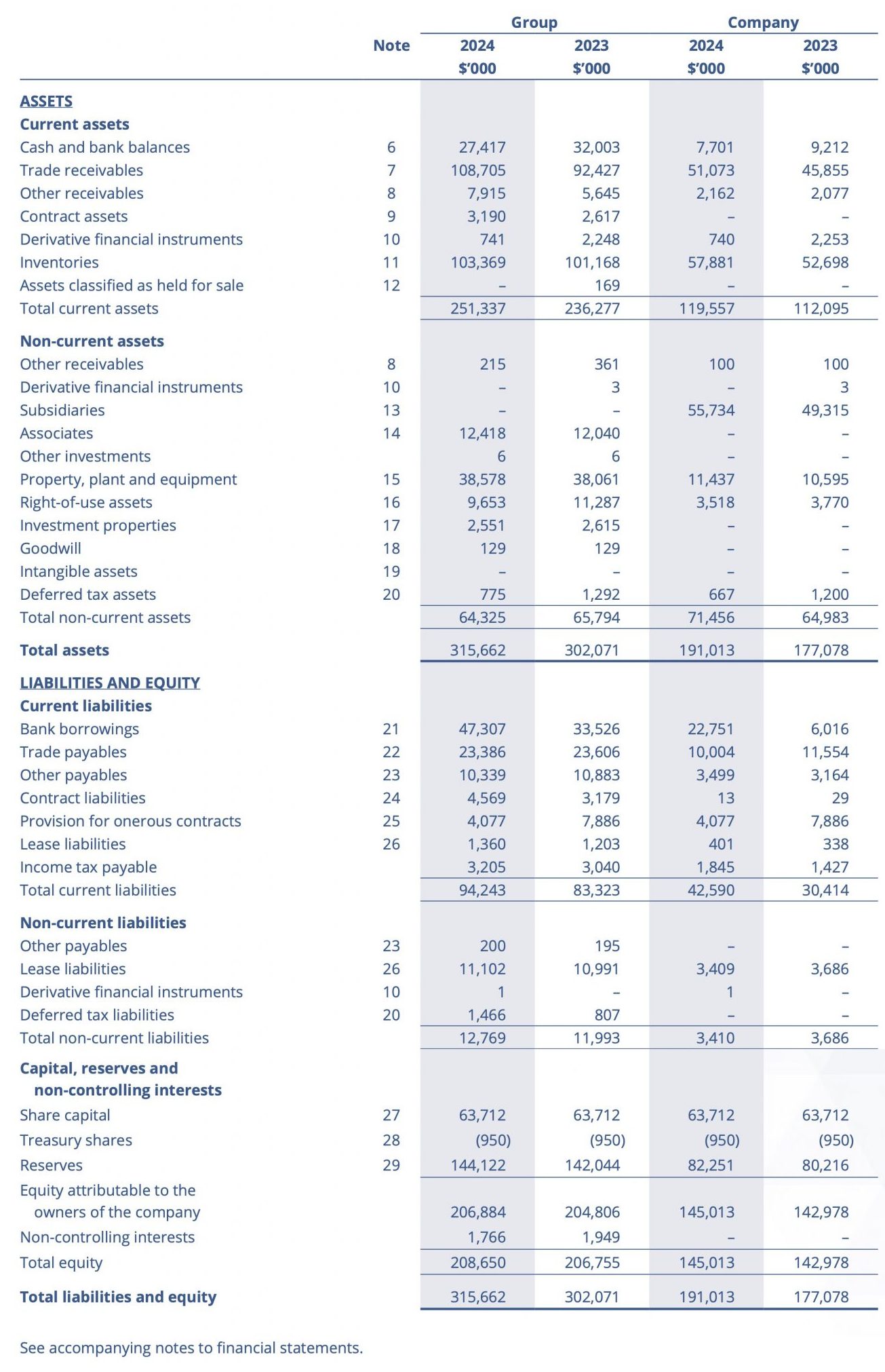

The cash and bank balance decreased by $4.586 million due to lower collections from customers toward the end of the current financial year, as well as cash used for the purchase of PPE during the year.

Trade receivables increased by $16.278 million due to slower collections from customers and higher sales toward the end of the current financial year.

Other receivables increased by $2.124 million, primarily due to higher advances paid for purchase of goods.

Contract assets increased by $573,000, largely because of unbilled revenue and retention sum receivables for those revenue recognised over time for on-going contracts.

The total value of DFI decreased by $1.511 million, mainly due to lower foreign currency forward contracts and copper contracts outstanding as at the end of the reporting period.

Inventories increased by $2.201 million, primarily due to higher inventories kept by the C&W Segment to meet the upcoming delivery demands and to mitigate potential shipment delays in the coming months amid ongoing global shipping disruptions.

PPE increased by $517,000 due to additions of plant and equipment totaling $7.464 million, offset by the impairment loss of $893,000, depreciation charges of $5.636 million, and the disposal and write-off of assets with a net book value of $106,000.

The decrease in ROUA of $1.634 million was mainly due to impairment loss of $1.430 million, depreciation charges of $1.615 million, de-recognition of ROU with the net book value of $32,000 against additions of ROU amounting to $1.485 million.

Deferred tax assets decreased by $517,000, mainly due to timing differences arising from the reversal of provision for onerous contracts during the current financial year.

Bank borrowings increased by $13.781 million, as a result of higher bank borrowings by the C&W Segment for copper purchases.

Trade payables decreased by $220,000, due to prompt payment to suppliers towards the end of the current financial year.

Other payables in total decreased by $539,000, because of lower provision for staff related costs towards the end of the current financial year.

The provision for onerous contracts amounted to $4.077 million, a reduction of $3.809 million from the end of the previous financial year, due to partial delivery of the contracts during the current financial year.

The cash and cash equivalents as at 30 June 2024 decreased to $27.417 million compared with $32.003 million at the end of the previous financial year.

The Group’s net cash from operating activities of $2.603 million was attributable to operating profit before working capital changes, and an increase in advances received from customers. This was offset by increase in trade and other receivables, contract assets, and inventories, decrease in trade and other payables, as well as the payment of income tax.

The net cash used in investing activities of $6.818 million was mainly for purchase of plant and equipment, net of proceeds from disposal of plant and equipment, proceeds from disposal of an asset classified as held for sale, dividend received from associates and interest received.

The net cash used in financing activities of $550,000 was mainly attributable to repayment of bank borrowings, dividends paid, lease liabilities and interest paid, net of proceeds from short-term bank borrowings.

The current market volatility and ongoing geopolitical tensions are expected to weigh on the global economy. While inflationary pressures may have stabilised and interest rates are expected to ease, the Group continues to be vigilant and remains nimble to navigate through the challenging business environment.

Notwithstanding these headwinds, the Group continues to proactively manage the ongoing price tension arising from the fluctuating copper prices as well as supply chain pressures.

Operational excellence remains a key focus. The Group will continue to execute its strategy and is constantly on the lookout for suitable business opportunities to drive sustainable growth in Southeast Asia, capitalising on resilient domestic demand underpinned by the continued development of digital infrastructure and the burgeoning green economy.